Thanks to my wife for her loving support. Thanks to Brain Zimmerman and Lance Beggs for their friendship, support and coaching.

"The world aint all sunshine and rainbows. It's a very mean and nasty place and it doesn't care how tough you are, it will beat you to your knees and keep you there permanently if you let it. You, me, or nobody is gonna hit as hard as life. But it ain't about how hard you hit, it's about how hard you can get hit and keep moving forward...how much you can take and keep moving forward. THAT'S HOW WINNING IS DONE!! If you know how much your worth then go get what your worth, but you have to be willing to take the hits, and not pointing fingers saying you aint where you want to be because of him, her, or anybody. Cowards do that and that aint you. You're better than that". Rocky 6

Wednesday, December 21, 2011

Monday, December 19, 2011

Thursday, December 15, 2011

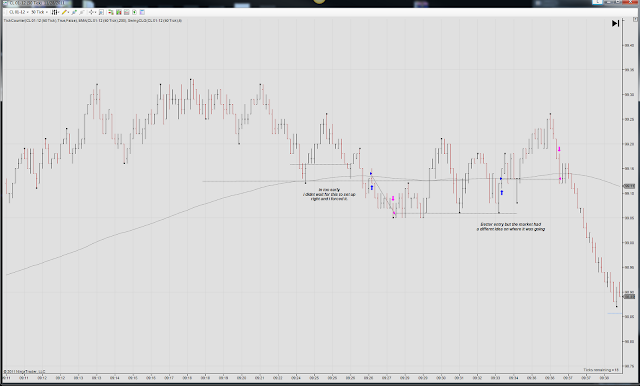

Over the past few months as I made the switch to crude and I had some difficulties engaging the short side. Timing was hard as price action was whipping around the area I planned to trade in. I was only taking long trades as I had better success with those. The short side was going to have to wait until I gained better confidence on my timing. One thing that laid in the back of my mind was its just not a market to be short in. Only time will tell. I think that time has passed and over the pass few weeks as crude is trading lower with good momentum the entries on the short side are better. The timing is not as wild. Reason?? Through screen time i gained an understanding of price action and seen strong markets and how difficult it is to fade them. So my theory remains true and the problems I had shorting crude (correction /reaction moves) when it was in a strong bullish market it just simple..... it not easy fading a strong market so don't do it. Look at the daily below

In order to fix a problem I have to identify the problem. Next for me is to take what I learned and apply it. In hindsight is all easy to say I should of could of. Since I don't trade in hindsight and trade in the moment I need to learn how to adapt to this. First thing that comes to mind is don't take the amature route and start looking to changing the whole system. If I'm having trouble with entries take a step back and look for reason. Ask and am I on the right side? Now don't look into this too deep and after a couple of losers freak out. Just be aware or the surrounding. I don't know if a market will continue to blast in a trend until its over so I have to realize that. I don't know if a sup/res level will hold and in a strong trend it will always look extended

(over sold/bought).

How do I adapt?? To be continued....... I'm hungry

Tuesday, December 13, 2011

12-13

Big push up at the open

Timing the short had been an issue with CL.something to study and work off of. Crude fell apart after its maga run up at the open but expected a macro complex structure to develop.

Hard to say since its after the fact but those first 3 trades on this chart could be forced as its not clear on

direction yet but its close. support does hold and shorts could be ready cover so I wanted in.

good trade these are what i like. I was not fast as i should have been here and it cost me 2 ticks.

Monday, December 12, 2011

12-12 trades

Classic tight range. Slow mover today and I didn't stay patient enough. I took a few trades but it wasn't one of those days to come in trigger happy. Live to trade another day.

Friday, December 9, 2011

i hate my boss

Funny I work for myself (which makes me the boss) and I still hate my boss at times. Trading has tested my personality many times forcing me to focus on my weaknesses in order to move forward. A year ago I struggled with taking losing trades. Today I struggle dealing with new equity highs. The more I make the less I want to trade. Complacency is poison to any performance driven result sports, sales, etc. I hate losing and hate it even more when I'm winning. For me its like walking up a hill with weight on my shoulders and the higher I climb that hill more weight is added until I cant move higher anymore. Lately I find my trading at a stall. I lost that chip on my shoulder that allows me to engage in the market. The P&L is positive and I find myself comfortable and this is BAD!!. This is causing conflicts with decision making. I want to trade as I'm feeling like a bum doing nothing but cant find the edge to engage.

Today I force a trade and wanted it to lose and just maybe it would boost my motivation. REALLY?? Since I'm more motivated when I'm losing as I'm in fight mode i thought this would be a good idea. I took a trade with 6 tick risk. The trade was low probability and when I got in I was entered with -1 tick slip and on the exit was granted-2 tick slip resulting in -9 tick loss plus commission. Well so much for that idea because now I'm pissed at myself and not motivated and $95 less on a Friday. One thing is for sure is Ill take a winning trade at some point , feel better about my trading and find myself sitting in front of the screen doing nothing but patting myself on the back for some long length of time unless I find a way to change this mental process.

Most traders including me try to avoid losing trade but yet its reason this whole stock market thing works. Has to be buyer and sellers. Some of us perform better when our backs are against the wall. Maybe I can find a way to embrace the losing trades more. I learn more from them and it fires the motivation up.

Today I force a trade and wanted it to lose and just maybe it would boost my motivation. REALLY?? Since I'm more motivated when I'm losing as I'm in fight mode i thought this would be a good idea. I took a trade with 6 tick risk. The trade was low probability and when I got in I was entered with -1 tick slip and on the exit was granted-2 tick slip resulting in -9 tick loss plus commission. Well so much for that idea because now I'm pissed at myself and not motivated and $95 less on a Friday. One thing is for sure is Ill take a winning trade at some point , feel better about my trading and find myself sitting in front of the screen doing nothing but patting myself on the back for some long length of time unless I find a way to change this mental process.

Most traders including me try to avoid losing trade but yet its reason this whole stock market thing works. Has to be buyer and sellers. Some of us perform better when our backs are against the wall. Maybe I can find a way to embrace the losing trades more. I learn more from them and it fires the motivation up.

Monday, December 5, 2011

Wednesday, November 30, 2011

Monday, November 28, 2011

Tuesday, November 22, 2011

Monday, November 21, 2011

Wednesday, November 9, 2011

Tuesday, November 8, 2011

Sunday, October 30, 2011

Monday, October 24, 2011

10-24

+22

strong move up. i didnt feel i did well on the exit. The market broke its high

and i wasnt sure where i wanted to cover. It was moving fast and I had seconds to decide.

I was up 5 ticks and then up 30 ticks faster than i could process what the hell i wanted to do.With the CL looking to be way up there i decided to take a scalp but this baby ran higher all day. thats trading

Friday, October 21, 2011

10-21 trades

I hate getting it right but still getting it wrong. not very smart to wait for the last hour to trade CL. I expected a strong sell off or a short squeeze but not sloppy price action. I tried to ignore it was late Friday as I had the read where the market was going. the Market failed to move lower and you can see it exhaust but timing the move up was no walk in the park. The set ups were not the best after looking at them.. it always seems that way right???

Thursday, October 20, 2011

10-20 TRADES

With baseball world series going on and the home town team in it I have to say I was lucky to stay up late with a few.....well ok lots beers and wake up too tired to engage in this market. About 2 hours of watching the markets flip flop direction back and forth i had enough and called it a day. Only bad things happen when I try to pick sides on direction.

here is the later movement for review. Were there clues?? I'm sure there is some

Days like this there is fine line of being a visionary, planning a trade, and forcing the market. Sometimes I get it all confused. Its important for me to realize when i do have it all wrong and stay out.

Wednesday, October 19, 2011

10 19 trades

no trades on 10-18 CL roll over and tough read overall. I decided to not trade. 10-19 S&P slap chopped in a tight contraction most of the day. CL offer a some trade worth jumping into. the Chart above shos morning trade and then in the after noon how I planned out my next trade. I was spinning my web looking for the trapped traders on the short side so I could take the other side but i was wrong in that direction. I can see were the analysis was off as price return back into the range. This is usually bearish but today i was holding truth that once the S&P broke up out from contraction it would send crude and the rest of the market with it. I was wrong.

As I waiting for price to correct and then trap shorts the move lower happened and the bears remained in control. My analysis was wrong and now I have to regroup. The hard part is once its clear on direction most of the time its too late. Ive been a sucker for trading at these levels and get burned most of the time. Today i just execpted i was wrong on my original analysis and looked for the next \wave to trade

Here are the trades I took for the day

Timing of the entries.

Even thought the P&L was up for the day the part to remember is trade the analysis, admit when your wrong and wait for the market to come to you. I dont have to be right all the time.... just most of the time ;)

Monday, October 17, 2011

Friday, October 14, 2011

10-13 and 10-14 trades

-300 on the day & -600 or something like that, for the week i lost count:

With your feet on the air and your head on the ground

Try this trick and spin it, yeah

You head will collapse

But there's nothing in it

And you'll ask yourself

Where is my mind

lyrics from the band Pixies

great song and that song popped in my head after trading like shit today. I felt like

i lost my mind today. I even moved over to crude to get some action to I could fight back.

i lost my mind today. I even moved over to crude to get some action to I could fight back.

Subscribe to:

Comments (Atom)